On Friday the FDIC seized control of the Silicon Valley Bank (SVB), the 16th largest bank in the United States and the one that catered specifically to venture capital in the tech sector.

So what happened? Well, Fox News aired this, which is the tell that it’s probably the wrong explanation:

Yeah, so that’s about as accurate a call as the one the umpire made to end the Mississippi Valley State-University of New Orleans baseball game over the weekend. The actual explanation is much more mundane.

Both Bloomberg and the Financial Times team have provided invaluable reporting on this. On Substack, both Adam Tooze and Noah Smith have accessible analyses for what happened, and I strongly recommend checking out both of their takes.

After reading all of this and more, my three bullet point summary of what happened:

SVB went long on low-interest government bonds a few years ago, back when interest rates were super-low, without any hedge against rates going back up. As Tooze put it, “It was not holding a safe piggybank. It was, in effect, taking a huge $100-billion-plus, one-way bet on interest rates.”

SVB was not a normal bank with lots of small depositors covered by FDIC insurance, nor was it a systemically-important bank that required it to hold extra capital. It caters to tech startups that, by their nature of being startups, hold large amounts of cash. According to Tooze, “at the end of 2022 only 2.7 percent of deposits were covered by FDIC insurance.” This meant that any whiff of something going wrong could trigger an old-fashioned bank run.

SVB did not communicate its situation well at all, leading Peter Thiel’s Founders Fund to advise its portfolio companies clients to get their money out. In a sector where communication is instantaneous, that was enough to start the Silicon Valley bank run.

This all went down just before the start of the weekend, which means it was a perfect there has been a tsunami of commentary about whether this is an inflection point or a one-off. It will shock you to learn that the answers being provided seem strongly corelated with how much time one has spent online — or in Silicon Valley. With the late Sunday joint announcement by Treasury, the Fed, and the FDIC that SVB depositors will be made whole, the likelihood of a wider run seems pretty remote now. But that was the topic of debate for much of the weekend.

For the doomsayers, the speed of SVB’s fall offers a cautionary warning. The very nature of fractional reserve banking means that even if a bank is well capitalized, it can still face a run if enough depositors decide simultaneously to get out. Since the start of the 2008 financial crisis, social media and mobile banking have exploded. Just as a meme can go viral, a meme stock can rise and fall, maybe bank runs can now happen instantaneously.

This has been the prevailing take I have seen among those in the know in Silicon Valley.

I am not so arrogant as to dismiss this possibility out of hand. We live in a country in which an awful lot of people are still sour about the economy even though job growth remains strong. It is entirely possible that ordinary folks start freaking out and start wanting to take their money out of banks and into their mattresses. As Noah Smith points out, “Panic doesn’t need a rational reason, and in a bank run, panic becomes a self-fulfilling prophecy.”

That said, my money will be on Americans not panicking. For one thing, most Americans don’t have to worry about their money. For most depositors in most banks, the FDIC insurance of up to $250,000 is enough to ensure that they’ll be made whole.

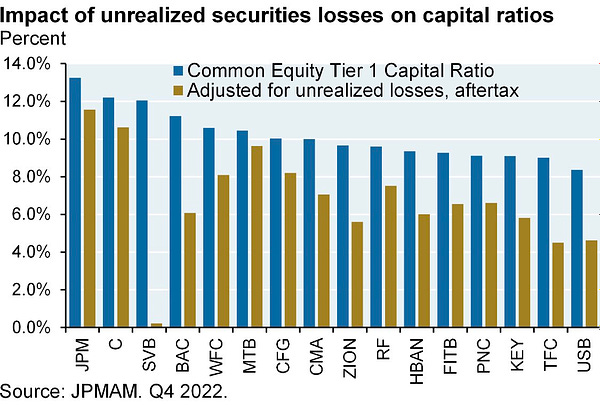

For another thing, it’s hard to stress just how much of an outlier SVB seems to be when it comes to prudential banking:

This should allow the Fed and Treasury to explain why SVB’s fall will not increase systemic risk. Depending on how the bank is resolved, SVB’s failure could have some knock-on effects but they seem limited. Indeed, SVB’s situation serves as a reminder that while Silicon Valley has been struggling for months, that struggle has not affected the broader U.S. economy.

The the late Sunday decision to cover all of SVB’s depositors might trigger public resentment against a perceived bailout of the tech sector. As a sector, Silicon Valley has managed to earn bipartisan calumny during a time when that’s really difficult to do. One the other hand, as Axios’ Felix Salmon points out, “this is nothing radical or new. Uninsured depositors have been paid out in full in every bank failure in living memory, with just one exception — IndyMac, in 2008.”

If the federal government can find buyers for SVB’s assets quickly, this will be an outlier story that is more about the politics than the economics.

If not...

Ah, Peter Thiel was involved. Thiel, who holds that democracy is bad for capitalism...

Most Americans are not concerned about the $250 thousand or whatever that is supported is because they don’t have it. Speak to what it means to those living paycheck to paycheck.