What if the United States... Continues to Get Better?

The United States is an imperfect union. But in many ways it has continued to become a more perfect union over the past year.

In December 2022 the hard-working staff here at Drezner’s World had the audacity to suggest that across a wide array of socioeconomic and sociopolitical measures, the United States really seemed to be getting better. In December of last year I doubled down on that hypothesis — buttressed by some robust data.

Saying that the country is on the right track amounts to heresy in November 2024. Look at the polls! Whether it’s Gallup, NBC, or a polling aggregator, the data all points in the same direction: roughly two-thirds of Americans are convinced the country is on the wrong track. That is due in no small part to Americans being in a sour mood about the state of the U.S. economy — as poll after poll has demonstrated. Americans remain scarred from the 2022-23 bout of inflation. Little wonder that Kamala Harris and Donald Trump have focused on being labeled the “change” candidate this coming Tuesday.

The hard-working staff here at Drezner’s World is well aware of these polling numbers. But the optimist in me notes that the trendline in all of those surveys has reversed itself over the past year. In other words, while two-thirds of the country might think the country is trending in the wrong direction, that percentage has declined as of late.

Furthermore, my conclusion is that the two thirds of Americans who believe the country is getting worse are wrong. Categorically, objectively, undeniably wrong. Across an awful lot of dimensions, the United States is getting better and better. And it is about damn time that we appreciated that fact, because the US of A remains an outlier relative to much of the world.

Why do I say this? Well, let’s look at the data. Why don’t we start with the economy. In their latest World Economic Outlook, the International Monetary Fund singled out the U.S. economy for being the engine of the global economy and upgrading its expected growth rate for the United States in 2025. Private-sector analysts, like JPMorgan or Forbes’ Christian Weller or surveyed economists, are equally bullish on the U.S. economy.

Why? It does not matter which metric one looks at — economic output, productivity growth, employment, the stock market — the United States outclasses the rest of the world.

This was a point that the Economist made rather vociferously last month:

Even more striking is how America has outperformed its peers among the mature economies. In 1990 America accounted for about two-fifths of the overall GDP of the G7 group of advanced countries; today it is up to about half (see chart). On a per-person basis, American economic output is now about 40% higher than in western Europe and Canada, and 60% higher than in Japan—roughly twice as large as the gaps between them in 1990. Average wages in America’s poorest state, Mississippi, are higher than the averages in Britain, Canada and Germany.

And America’s outperformance has accelerated recently. Since the start of 2020, just before the covid-19 pandemic, America’s real growth has been 10%, three times the average for the rest of the G7 countries. Among the G20 group, which includes large emerging markets, America is the only one whose output and employment are above pre-pandemic expectations, according to the International Monetary Fund.

Coupling this growth with the dollar’s strength translates into heft for America and wealth for Americans. That can be seen in the huge numbers of Americans travelling and spending record sums overseas. A decade ago (as Chinese travelers too were demonstrating their wealth) many analysts thought that China would, by now, have overtaken America as the world’s biggest economy at current exchange rates. Instead its GDP has been slipping of late, from about 75% of America’s in 2021 to 65% now.

The Wall Street Journal’s Greg Ip recently stressed the role that robust U.S. productivity growth has played in all of this good economic news:

Higher productivity growth should make the economy a bit less prone to inflation, more capable of sustaining budget deficits, and more likely to deliver strong wages. All would be a boon to President Trump or President Kamala Harris….

Most leaders from around the world would trade their economies for the U.S.’s in a heartbeat. Through the second quarter, the U.S. grew 3%; none of the world’s next six largest advanced economies grew more than 1%. Even China is struggling.

Sometimes strong growth is a prelude to a recession because it comes from straining the economy’s capacity, generating inflation and forcing the Fed to raise rates.

Yet inflation has fallen in the past year, to 2.7% in the third quarter, using the Fed’s preferred underlying measure. That’s still above the Fed’s 2% target, but the progress was sufficient for the Fed to cut rates in September and pencil in more cuts—all without growth flagging….

The Bank for International Settlements, a Swiss-based umbrella group for central banks, calculates that from the end of 2019 to the end of 2023, total output rose 7.9% in the U.S., of which 1.2% came from more hours worked and 6.7% from productivity—more output per hour. In the eurozone, output was up 3% in the same period, entirely due to more hours.

“Productivity is really bad across the world,” said Hyun Song Shin, the BIS’s economic adviser. “The U.S. is an outlier.”

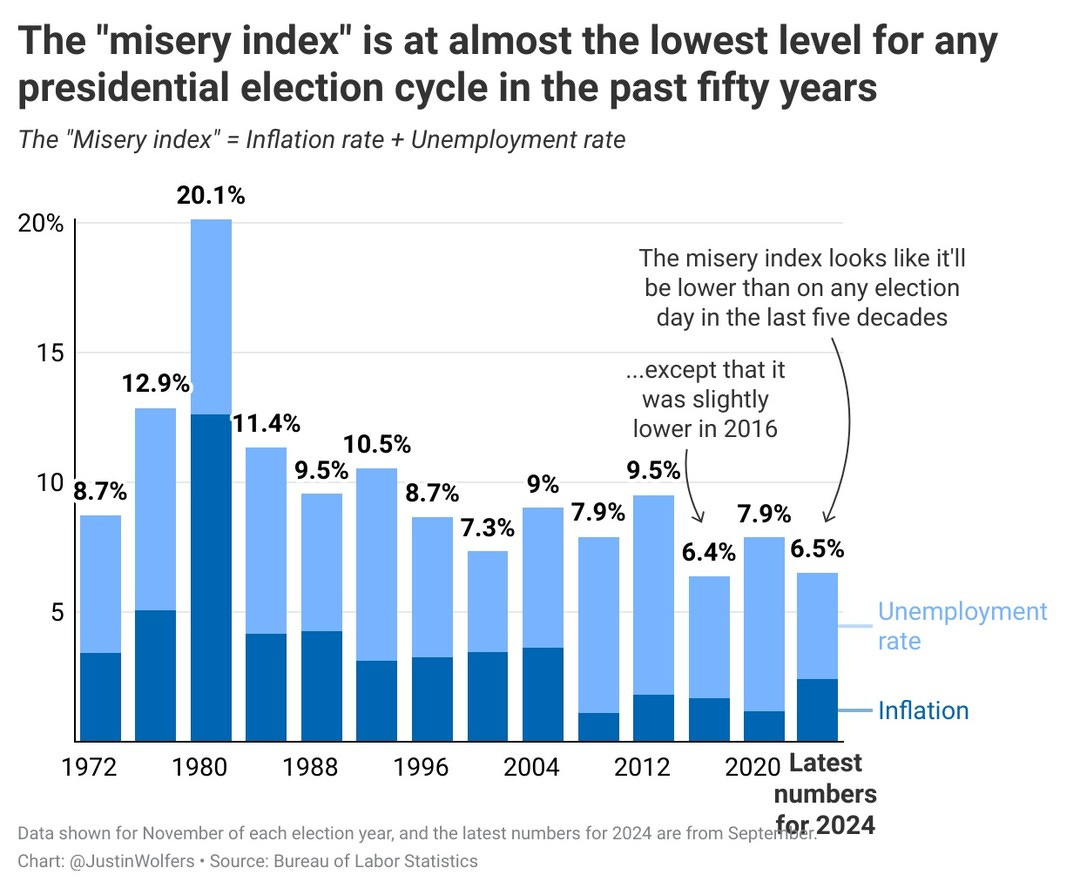

Inflation has continued to cool as well, falling back to where it was in 2018. The result is that the misery index — the combination of inflation and unemployment — is pretty, pretty low, as Justin Wolfers notes:

But enough about the economy — what about other societal indicators? Well, there is crime. The FBI data for 2024 echoes the trendline that 2022 and 2023 showed: violent crime is declining at a steady clip. But there are a lot of different crime statistics and all of them are imperfect. Therefore, I’m going to outsource all the criminological analysis to Jeff Asher, who has forgotten more about U.S. crime statistics than most Americans have ever learned about them.

This past week he summarized the state of play:

Murder is declining at the fastest rate ever recorded in the United States while violent and property crime remain at the modern low levels experienced for most of the last 10 years. Evidence from multiple sources point to declines in both violent and property crime in 2024 while the decline in murder is accelerating this year after falling at a record rate in 2023….

The decline in murder has been quite widespread. Murder was down in 35 states in 2023 compared to 2020 with a double digit percent decline in 25 states. Murder declined in 28 of the 37 states (76 percent) that reported at least 100 murders in 2020.

Murder is not down everywhere, but murders was down through August 2024 compared to the same timeframe in 2020 in 28 of the 34 cities that had at least 35 murders through August 2020….

Simply put, murder and gun violence are plunging regardless of the source used. The FBI’s estimates say this, the CDC says this, the Gun Violence Archive says this, NORC’s Live Tracker says this, Major Cities Chiefs says this, the Council on Criminal Justice says this, and the Real-Time Crime Index says this. The historic decline in murder since 2020 is large and widespread throughout the country with the only uncertainty attached centering around how big it will end up being when all is said and done….

The US reported property crime fell in 2023 to the lowest level since 1962 (again, ignoring 2021’s flawed estimates) in spite of a large increase in motor vehicle thefts….

Violent crime and property crime are tougher to accurately measure due to incomplete reporting, but all indicators point to relatively stable levels at or near historic low rates in both categories in 2023 and evidence of strong declines so far in 2024. These trends are identifiable through a variety of sources which accurately paint a picture of crime in the US. These trends are visible in spite of the frequently discussed flaws in FBI data, not because of them.

It’s not just that fewer crimes are being committed — Americans also appear to be less likely to act in a… let’s say “unregulated” manner in public. For example, the number of “air rage” incidents declined by 20 percent in 2023.1

So the economy is going strong and crime is trending downward. Are there other promising socioeconomic trends?

There are! For one thing, after decades of trending in the wrong direction, the U.S. obesity rate has started to decline. The U.S. Centers for Disease Control reported that the adult obesity rate — which was 41.9% in 2020 — had declined to an estimated 40.3% by 2023. The Financial Times’ John Burn-Murdoch explains why:

We have known for several years from clinical trials that Ozempic, Wegovy and the new generation of diabetes and weight loss drugs produce large and sustained reductions in body weight. Now with mass public usage taking off — one in eight US adults have used the drugs, with 6 per cent current users — the results may be showing up at the population level.

While we can’t be certain that the new generation of drugs are behind this reversal, it is highly likely. For one, the decline is steepest among college graduates, the group most likely to be using them.

Crucially, the US National Health and Nutrition Examination Survey, which reported the unprecedented decline in obesity levels, uses weight and height measurements taken by medical examiners, not self-reported values. This makes it far more reliable than other surveys. American waistlines really do seem to be shrinking….

In America and beyond, the dividends will be enormous. After smoking rates began falling, rates of lung cancer promptly peaked and then dropped precipitously, saving millions of lives. If obesity curves do now descend, rates of cardiometabolic disease and death should follow. More promising still, a growing number of trials find the addiction-suppressing mechanism of the same drugs can also reduce rates of alcohol misuse and even avert opioid overdoses.

This might also help to explain another promising trend: the decline in opioid-related overdose deaths. According to the Guardian’s Melody Schreiber:

Overdose deaths in the US have dropped by about 10%, the largest decline in decades – falling to an estimated 101,168 deaths annually as of April 2024, according to an analysis of state-level data.

Emergency room visits for overdose are down by 24% and 911 first-responder calls for overdoses are down by 16.7%. Some of the biggest changes are being seen in eastern states, while some states in the west are still struggling with higher rates….

“The recent declines in estimated overdose deaths are unprecedented, robust, and appear to be reflecting real trends,” Dr Nora Volkow, director of the National Institute on Drug Abuse (NIDA) at the National Institutes of Health, said in an emailed statement. “These data give us hope that we may finally be making significant progress in reducing the devastating loss of life from the overdose crisis.”

Among American teens, the trends are also positive. High school graduation rates are at an all-time high and teen pregnancy rates are at an all-time low.

Some observers, like the Wall Street Journal’s Gerald Seib, even go so far as to argue that American politics has stepped back from the brink of polarization and violence. I am not quite that optimistic, but I do think Noah Smith is onto something when he writes about “America’s calming trend.” He argues, “the violent street battles between rightists and leftists that characterized the years of 2016-2020 seem to be over…. The wave of ‘stochastic terrorism’ — the mail bombings of 2018, a string of shooting attacks on minorities, etc. — seems to have petered out as well.”

So, to sum up, since the end of the pandemic:

The U.S. economy is doing really well in general and particularly well when compared to its G7 peers;

Both property and violent crime in the United States have plummeted;

Other metrics of socioeconomic health, like obesity or opioid deaths, are trending in the right direction for the first time in a long time.

In other words, there is a plausible scenario whereby, years from now, we will see 2024 as the moment in which the United States fully absorbed the myriad shocks of the last fifteen years and moved forward. And that would be very much worth celebrating.

Alas, the road rage data is less promising, as both the data and the reportage suggest an awful lot of Americans are still driving way too aggressively.

Okay, call me an outlier, but I’m a Harris voter who thinks the country is going in the wrong direction. That’s WHY I’m a Harris voter.

Of course the economy is the envy of the world, crime is down, drug deaths have started declining. But Republicans have virtually paralyzed Congress. Almost nothing legislative that needs to be done and could be done is getting done.

In the end, asking whether the country is going in the right direction is simply too broad a question to generate a meaningful response.

Thanks for the boost!

I do want to raise a point that I have raised elsewhere, though. I'm not sure how much stock we should place in "right track/wrong track" polling questions. If I were asked this, I might well think first about the dominance of the MAGAt point of view, the rise in militant Christian Nationalism, the fact that Trump, ffs, is still a coin toss away from getting reelected, and one of the two major parties has lost all spine and moral compass. So, I might well say "wrong track." I suspect I'm not alone in this.

I should add that I completely buy the statistical picture that you presented -- of course I think most things are going pretty well in the US. My only point here was about the ambiguity of that one poll question.